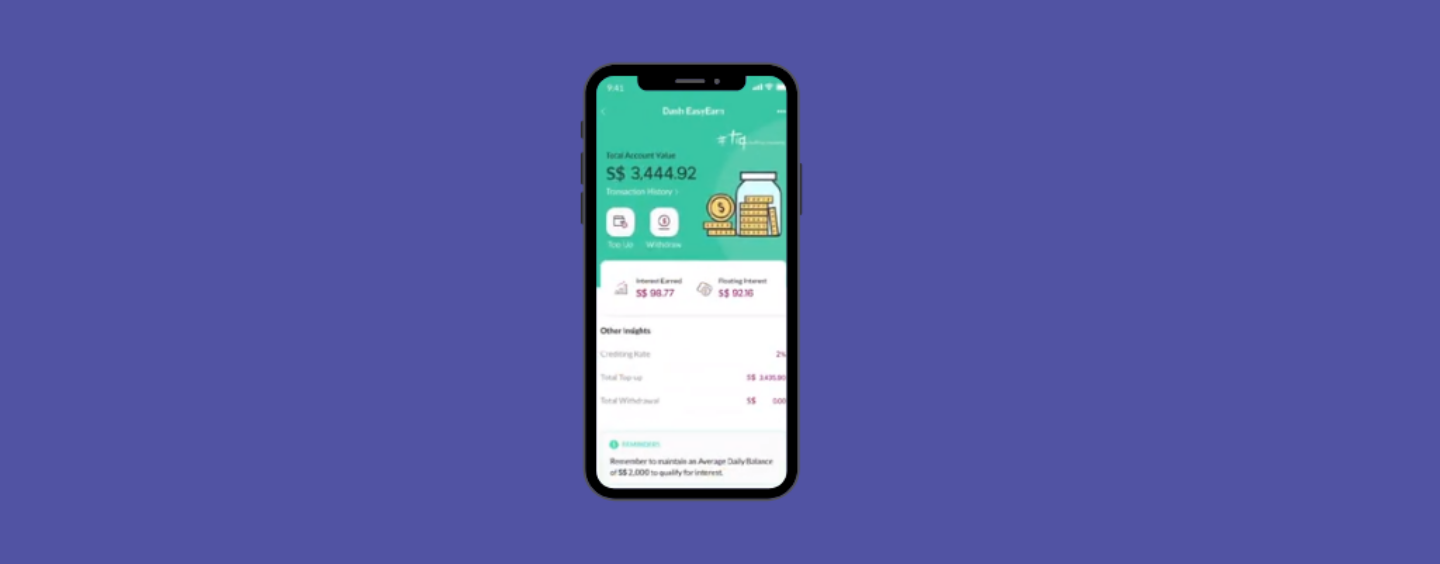

Singtel’s Dash App Launches Insurance Savings Plan Underwitten by Etiqa Insurance

by Fintech News Singapore July 1, 2020Singtel has launched an insurance savings solution for consumers looking to start their savings journey. It is offered exclusively through Singtel’s Dash app and underwritten by Etiqa Insurance.

This adds to their existing financial services which currently provides payments, mobile data top-ups, e-commerce, lifestyle and remittance services. This insurance savings solution is designed for investors who want to start saving regularly for their future but who may be concerned about cash flow, especially during these challenging times.

They can start a Dash EasyEarn plan with a minimum initial premium of S$2,000, up to a maximum of S$20,000. Other benefits include up to 2% per annum returns for the first policy year, no lock-in period and unlimited withdrawals with zero penalties.

Gilbert Chuah

Mr Gilbert Chuah, Head of Mobile Financial Services, Singtel’s International Group says,

“Dash EasyEarn represents the next steps for Dash as it grows to become a more inclusive everyday app that will play a bigger part in enabling our customers’ digital lifestyles. With Dash EasyEarn, customers can start growing their savings with greater convenience with a fully digital insurance product accessible on their mobile phones. We will continue to use technology to glean deeper business insights, better understand the needs and habits of consumers and bring them the products and services that they want.”

Dennis Liu

“Dash EasyEarn was co-created by Singtel and Etiqa to meet the financial needs of digital savvy consumers, who increasingly seek simple and convenient solutions through all-in-one mobile apps. We are honoured and appreciate the opportunity to work with Singtel to close the distance between people, their money, and services. This strategic partnership epitomises Etiqa’s commitment to pursue financial inclusion through innovation and constantly deliver added value to our customers,”

said Mr Dennis Liu, Head of Digital and Business Transformation and Technology of Etiqa Insurance Pte. Ltd.

As an insurance savings plan, Dash EasyEarn offers up to 105% of the account value in the event of death. It also allows users to withdraw their funds any time in case of emergencies without penalties or any interest clawbacks.

To sign up, eligible users in Singapore only need to verify their personal details before topping up using their bank account to get started. Dash EasyEarn is open to eligible residents in Singapore and is available only through the Dash app.

Since its launch in 2014, Dash has expanded beyond payments and mobile remittance to include lifestyle services like restaurant bookings and travel insurance. Dash, which counts over 1 million registered users, is available to everyone regardless of telco or banking relationship, and can be downloaded on any mobile platform.