TDI PoV: Industry Warning – digital tipping point is approaching insurers faster than expected

Executive teams must urgently accelerate their transformation efforts

In this TDI Point of View, Simon Phipps considers the strategic impact of the 2020 Coronavirus pandemic on cross-industry digital adoption and why, critically, insurance executives should consider accelerating investment in digital transformation roadmaps, and in particular, digital learning & development, as a key strategic priority – right now.

The 2020 Coronavirus pandemic has, in just a few short weeks, turned the world upside down.

Whilst, ultimately, mankind will prevail and things will start to settle down, our post-pandemic world will never be the same again. It will change the way we shop, travel and work forever.

Things we previously took for granted will be re-evaluated in many different ways. New norms will be established, instilled in society cultures that define us for generations to come.

One of those is digital, and the accelerated use of, and increasing comfort with, new technologies as a consequence of the rapid responses by governments, businesses and individuals to try and contain the outbreak.

Fueled by the meteoric rise of tech giants such as Google, TenCent and Facebook, peoples’ lives were already on a journey of digital adoption, particularly among the younger generations. But now, crisis responses have forced the entire world into the digital age and for many, the benefits will remain long after the pandemic subsides.

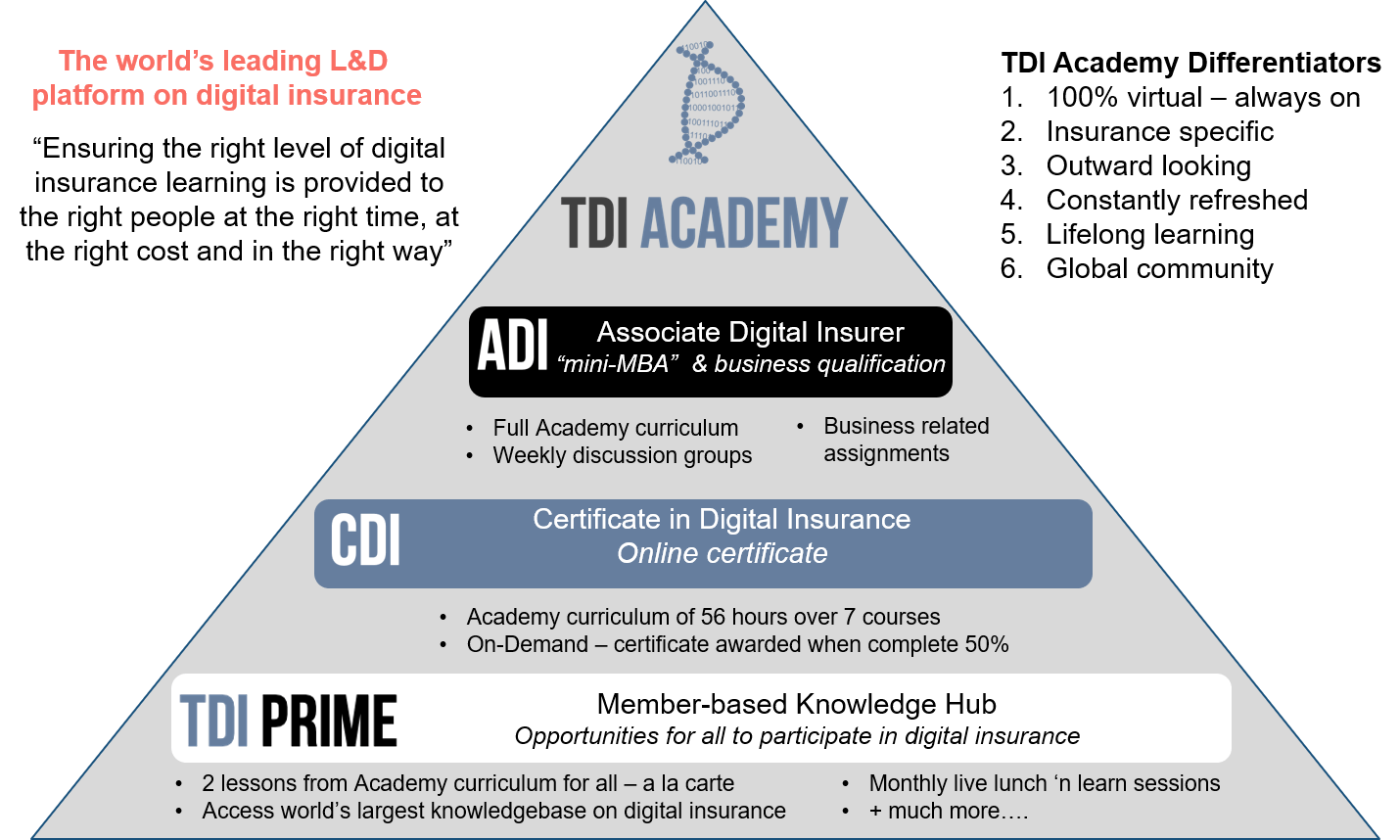

Academics refer to the point of mass adoption as the tipping point – the stage of development beyond which there is no going back. Unquestionably, the 2020 crisis will accelerate the world to the tipping point for digital adoption, as illustrated here (Fig 1).

Implications for insurers

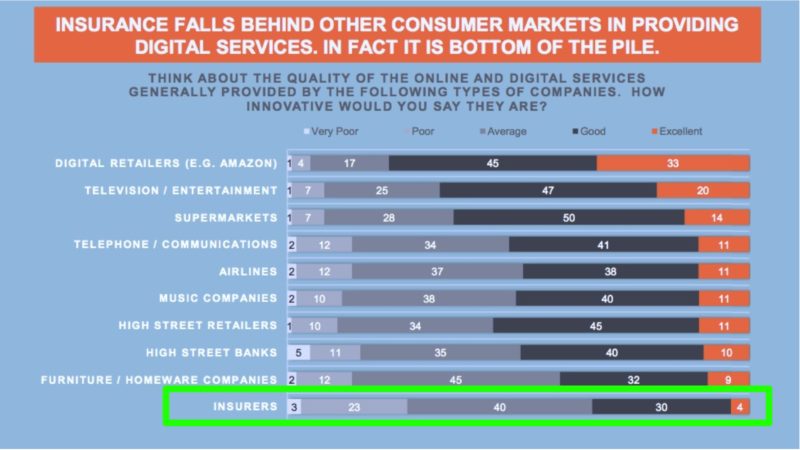

Insurers have, to varying degrees, been laggards in the application of digital technologies across their businesses, when compared to other industries. The consequence of this is clearly demonstrated in the chart below.

Few have taken big bets on tech, preferring to test and learn, and run PoCs in safe and controlled environments, whilst prioritising protection of their core business and financial returns over significant, tech-enabled change.

With the global, cross-industry adoption of digital accelerating in 2020, this presents additional challenges for many insurers. At a time when the industry was already behind the curve, insurers are now at risk of being left further behind as the world of consumers, and the world of employees, moves on. In other words, the lifeblood of all insurers.

1.Insufficient priority given by insurers to accelerated strategic focus and investment during unquestionably difficult times

2.Pandemic crisis accelerating consumers up to and beyond tipping point much sooner than previously expected

This means five-year transformation plans will need to be significantly recalibrated, if insurers are going to both stand shoulder-to-shoulder with digital-native partners and competitors, and survive and thrive in the new norm.

The widening gap between consumers’ digital expectations, and insurers’ readiness to meet their needs

How can insurers accelerate their digital transformation efforts?

This is a big, broad question, beyond the scope of this PoV, as there are of course multiple considerations and ways to achieve this. Consulting firms will have a field day if you engage them to answer this question!

So instead we will adopt a hypothesis-led approach with the presumption that there is one thing, beyond any other, that will ‘move the needle’ on digital transformations and cultural change – our people.

Increasing awareness of, and enthusiasm for, digital applications across the business is likely to be the single biggest thing that you can do to accelerate the journey of digital transformation. At TDI we have believed for some time now that for digital to become mainstream in insurance, the conversation and engagement needs to move ‘from the few to the many’ (Fig4).

In other words, moving digital engagement beyond the digital teams and innovation specialists – to everyone.

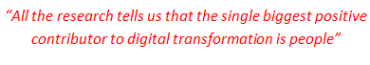

Fig 5: McKinsey Research shows the critical importance of People in transformation programmes

Only in this way can you instil and foster a true sense of both curiosity and urgency in seeking out new ways to leverage technology for the benefit of the business overall. Only in this way can you build an insatiable appetite for doing things better with tech and create an unstoppable momentum of change that sweeps across the business, seeking out tech-enablement opportunities big and small, across every function and process.

Accelerating Digital Transformation – the power of people

The research on this page provides some critical insight into the various levers of value when it comes to digital transformation. What is particularly interesting in the chart opposite (Fig 5), is how many of these are dependent upon people.

Yet how many insurers are taking this dependency upon people across their businesses seriously?

Fig 6: McKinsey Research shows the critical importance of People in transformation programmes

To be fair to insurers, there are some good examples of where companies have arranged leadership visits to new tech firms in China to instill a sense of enthusiasm for what the future might be, or perhaps ‘sheep-dipped’ key staff through change management or digital marketing courses in the hope that this will enable a step-change. And these efforts are to be commended, as everything helps.

But the harsh reality is that in the majority of cases, these efforts have been initiated by digital leaders, and often paid for out of digital innovation budgets, with ExCo leaders and CEOs curiously going along for the ride. Noble efforts – but hardly a sustainable, strategic response. Digital leads are being let down by their executive teams – and also perhaps in some instances, not sufficiently stepping-up themselves.

Thought leaders echo research findings

There is also increasing evidence among thought leaders that companies need to embark on a journey of change with their teams:

So if people are at the very heart of enabling accelerated digital transformation, why aren’t insurance companies investing more seriously in this area? Here’s a personal starter for ten on what that list looks like:

- No ‘burning platform’ compelling CEOs and ExCos to act

- No mandatory actions being specified by regulators

- No personal stimulus from CEOs, typically based on a lack of digital experience, to instill a sense of urgency

- Inappropriate positioning of Disruption Risk on heat maps managed by the Risk Committee – both in terms of probability, timing and, likely severity of impact – these urgently need review

- Digital leads themselves failing to create sufficient advocacy across the business – often a result of hiring strategies which over-emphasis tech vs change management skills

- Weak business strategy reviews failing to identify the importance of digital-enablement and culture to business survival

- HR leads not stepping-up. To be fair to many of them, the harsh reality is that they still don’t have parity at the top table – so instead of being the custodians of culture and champions of change – they continue to languish in the (very important, but tactical) world of people administration. How can it be that digital leads are the ones using their budgets to pay for staff training in digital… trying to move the needle bottom-up? It’s like trying to push water uphill. HR leads of course can not and should not be expected to do everything. But as the custodians of culture and organisational change on behalf of the Executive Committee, they need to be empowered to assume the role of ‘conductor of the orchestra’, helping to plant seeds, enable focus, secure budgets and, ensure things are getting done

- Life-long digital learning & development (L&D) is needed by the many, not just the few

- Existing L&D is not fit for this purpose. Training departments have been too comfortable for too long in the traditional ways of doing things – such as an over-dependency on face-to-face, lacking agility, scalability and cost effectiveness.

This PoV paper will hopefully cause some reflection amongst senior teams on points 1-6 above. We are now going to reflect more deeply on L&D in relation to 7, 8 and 9, to better understand the current limitations, explain why change is needed and, explore some of the ways in which TDI can help.

Lifelong digital learning & development is needed by the many, not just the few

Fig 7: McKinsey Notes from Davos 2020

Digital is the 4th industrial revolution, and we are in the early stages of a significant period of irreversible change. Like Moore’s Law, the pace of this change is exponential – even more so with the onset of the 2020 Coronavirus pandemic.

As momentum builds, the need for awareness, understanding and knowledge is quickly moving from the few (digital specialists) to the many (business managers and leaders).

Technology is presenting opportunity for change at different levels – from ‘Improving Today’ (Value Chain Innovations) to ‘Reinventing Tomorrow’ (New Digital Business Models).

All managers and leaders need to be equipped to participate in technology-enabled change – a common set of core skills plus some deeper skills, is required by all.

With a plethora of new technologies and buzzwords, most people know they lack a basic understanding of these new technologies, let alone their business application potential. This applies at all levels throughout the organisation.

And the requirement is not for one-time education, but is rather for on-going, life-long knowledge acquisition, as the pace of new tech development is out-stripping the ability of individuals and companies to keep up – a point noted earlier this year by McKinsey in Davos (Fig 7).

TDI’s InsurTech Wheel

Source: TDI

Fig 8: Raconteur LinkedIn Research shows increasing budget availability for L&D

Existing training solutions are typically not up to the job for digital insurance L&D:

- Content is not dynamic and often out-of-date

- Deployment mechanisms are largely out-of-touch with how people like to consume knowledge during their increasingly busy lives

- Tech-focused L&D solutions are typically sector agnostic i.e. missing insurance sector nuances

- They are also typically tech-led rather than starting from the premise that it is the user and business application of technology which is the key to the generation of business value.

Internally, insurers also struggle to meet the growing development needs of employees:

Fig 9: Raconteur Research report shows increasing trend to Online learning (Fig 9) and employee awareness of skill gaps

- Individuals increasingly like things that are transferrable, and for insurers, supplementing internal L&D with external input should be strengthening the brand and employee proposition by reinforcing signs of an open, innovative and collaborative culture

- There is a void in the area of digital technology vocational L&D that focuses on the insurance industry.

Increasing evidence also points to the changing ways in which L&D needs to be deployed.

Research also shows us that employees are increasingly aware of there own skill gaps and looking increasingly to their employers to help address these.

Hearing much of this feedback from the market over the last 18 months, and extrapolating these insights, the team at TDI decided to act. In line with our purpose of ‘Working Together to Accelerate the Digital Transformation of Insurance’, we realised that we are uniquely placed to help support awareness of, and enthusiasm for, digital moving ‘from the few to the many’ – from Board and Exec tables down.

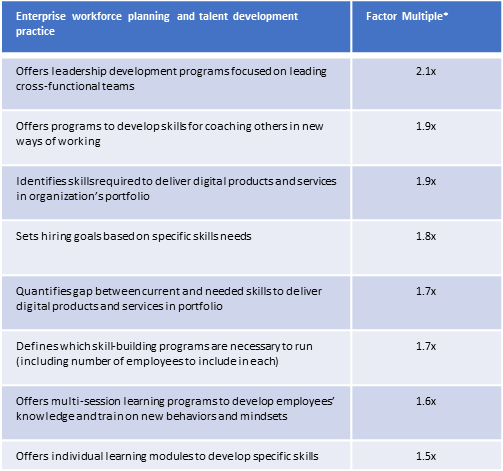

Introducing TDI Academy – Insurance learning for the digital age

Driving awareness and engagement in digital innovation from the few to the many, to help accelerate your digital transformation.

After using much of 2019 researching, planning and building its first steps, the TDI Academy launched its first programme, the Associate Digital Insurer (ADI) as the industry’s first mini-MBA on digital insurance, in January 2020. The first cohort was sold out to TDI Corporate Members, with the second cohort beginning in April.

As a greenfield operation, TDI had the fortunate position of being able to develop a modern, digital-first platform with dynamic content to underpin its success. Design Principles embedded across the TDI Academy programmes can be seen below:

Feedback from participants and sponsors has been excellent, surpassing all expectations.

Bringing forward new programmes to further help insurers accelerate their transformation in this time of need

TDI planned to use much of 2020 to test, learn and iterate improvements in its flagship ADI programme.

But, as a result of overwhelmingly positive feedback on its inaugural ADI programme, and the unprecedented developments unfolding around the world, we have decided to bring forward plans to introduce two further programmes in 2020:

- Executive Digital Insurer [EDI] programme – designed for executive leadership teams

- Certificate in Digital Insurance [CDI] programme – fully online, designed for deployment to larger numbers of staff across multiple offices and geographies.

Insurance Executive teams must accelerate transformation efforts now

As we considered at the beginning of this paper, the world is going through an unprecedented level of change.

A key outcome of this will be new societal norms, including an accelerated adoption of digital. This is already raising the bar of expectations for consumers and employees, on what companies offer them.

As relatively slow adopters of digital, incumbent insurers face being overtaken by better-equipped competitors and/or new entrants, if they don’t raise their transformation game, right now.

As mentioned previously, TDI estimate insurers now have two to three years less to execute their digital transformations than they did six months ago, in order to avoid being disrupted, or swallowed-up.

Leaders need to be, and be seen to be, taking more immediate and firm action, to attract and retain customers and staff, post-crisis. Actions to accelerate this cannot wait until we settle back to normal, as the normal world we knew a few months ago has already fundamentally and irrevocably changed.

Stepping up now, to ensure the best position for your business as the world stabilises

Real digital transformation requires a change in culture, meaning that digital needs to move from ‘the few to the many’ – leaders therefore need to quickly implement ways to accelerate staff understanding of, engagement in and, enthusiasm for, digitalisation of their business.

The Coronavirus pandemic has unquestionably given leaders plenty of immediate challenges in areas such as remote working and BCPs, reduced new business flows, the potential for increased claims, lower investment returns and, perhaps capital adequacy and solvency ratio challenges too. But, many of these headwinds are well-within leadership teams’ abilities to manage, with established plans and contingencies already in place. And when the world starts to stabilise, which it will, people are going to be far more conscious of the need for protection, and seek insurance solutions. So medium-term the outlook is increasingly positive, for the insurers that survive. To achieve this, they need to step-up their digital transformation efforts now.

Is going back to business as usual seriously an option?

Is six or more months of tactical activity going to help your chances of survival in the longer-term?

If not, don’t CEOs and their leadership teams have a responsibility to act, right now, to embrace the new challenges and opportunities of our digital-first world?

Please reach out to TDI Academy to explore the ways in which we can help. Now, more than ever, is the time for all of us to work together, to accelerate the digital transformation of insurance.

Let’s get this transformation done

Summary of TDI Academy’s programmes – further details available at https://www.the-digital-insurer.com/tdi-academy